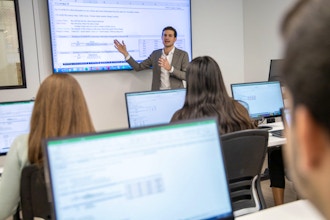

AMA's Finance Workshop for Non-Financial Executives

Enhance your financial acumen and make informed business decisions with AMA's comprehensive finance workshop designed for non-financial executives. Learn essential topics such as cash flow, value creation, financial statement analysis, and more. Elevate your finance knowledge and interact intelligently with finance colleagues to drive shareholder value.

- All levels

- 21 and older

- $2,995

- Earn 29,950 reward points

- 1601 Broadway, New York, NY

- 30 hours over 4 sessions

CourseHorse Gift Card

CourseHorse Gift Card